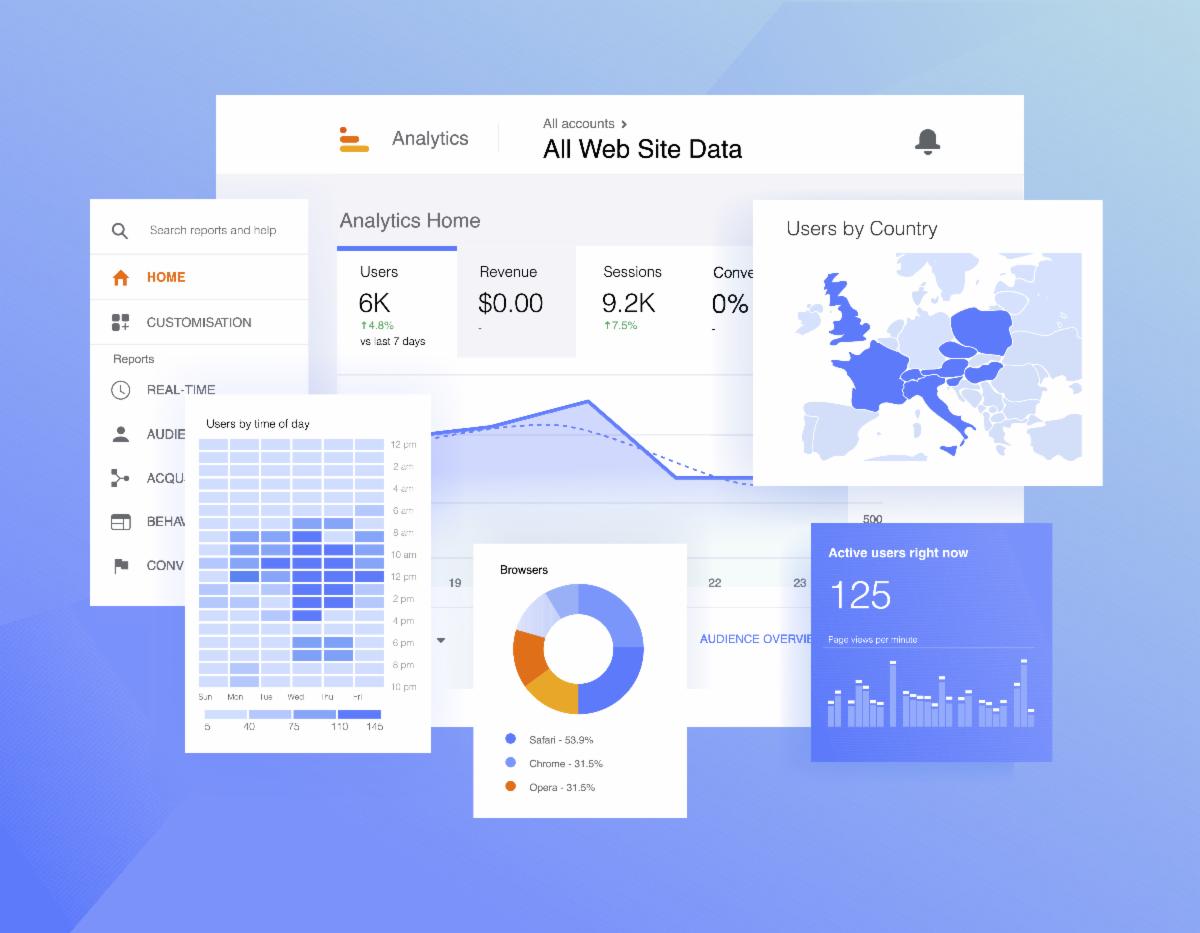

For clients looking for a proxy solution, CCC has partnered with Proxytrust. Proxytrust provides comprehensive proxy voting and strategic partner solutions including capital changes, cost basis calculator and policy voting. In this capacity, CCC will take the lead in determining the best source course of action to retrieve the necessary data that Proxytrust needs to deliver its proxy services. Once that data infrastructure is established, Proxytrust and their talented group of professionals will onboard our clients on to their online proxy portal. Clients will then be able to completely automate their proxy needs through this solution.

Download The Presentation When clients have investments where foreign governments are withholding taxes for overseas securities, CCC may be able to help. Depending upon the country and its treaty with the United States, CCC may be able to reclaim some or all of the tax withheld. CCC has internal and external resources to evaluate your withholding tax situation, analyze the jurisdiction, and implement the best strategy to reclaim your withholding.

CCC is the class action industry expert in creating fair, equitable, and remunerative coupon and certificate settlements. We've been the court-appointed market maker in 19 distinct settlements and consulted on countless others. When law firms want to craft a coupon settlement that will win the approval of the courts and the class members alike, they turn to CCC. Since our founding in 1993, we have helped millions of claimants cash in well over $300 million settlement coupons and certificates.