CCC uses the most secure and user-friendly data storage platforms to warehouse our clients' trade data. We now offer this same Warehousing Service to investors, hedge funds, pension funds, law firms, and research groups as a stand-alone storage and reporting solution.

Download The Presentation

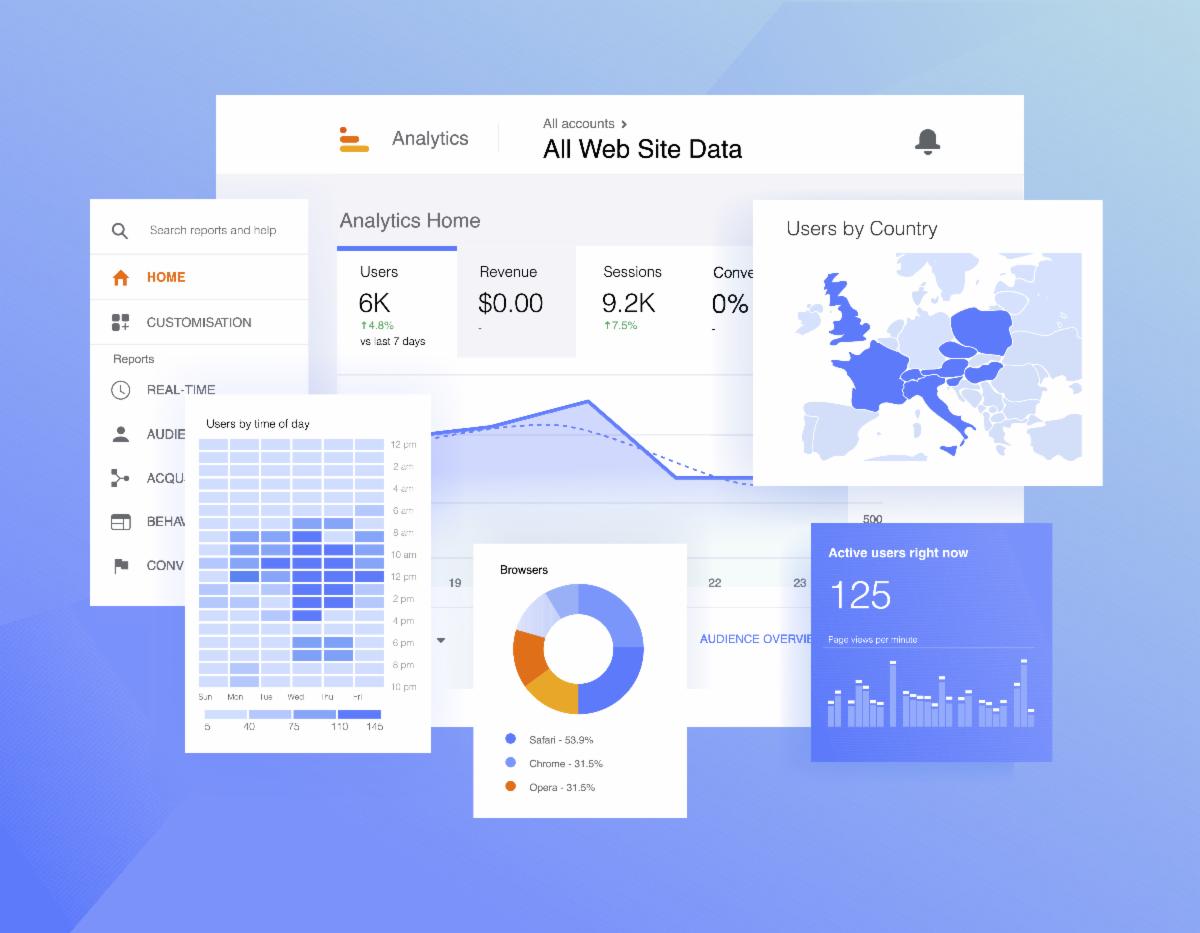

Our practices and security controls are certified according to SSAE 16, SOC 1 & 2 Type II standards. This means that CCC's service organization controls have been certified by professional auditors according to the standards established by the American Institute of CPAs. Available 24 hours a day, the Data Warehouse lets users analyze data, run reports, and perform data mining research. You can upload and download with ease and run customized reports from whichever fields you choose.

Our operations team has mastered the normalization of trade data. No matter the source, we can create a uniform record of thousands of accounts and millions of lines of trades. Historical look-back research (and even the occasional audit) are no longer things to be dreaded. (Well, maybe still the audit, but it will be much easier!) With CCC, research and reporting can be as simple as selecting the terms and exporting the data you need.

CCC can alert you whenever we need to update your data. Our proprietary software will detect any gaps in open accounts and automatically send upload requests when updates are needed. Whenever you need to access your data, you can, and expert assistance is always just a phone call away.