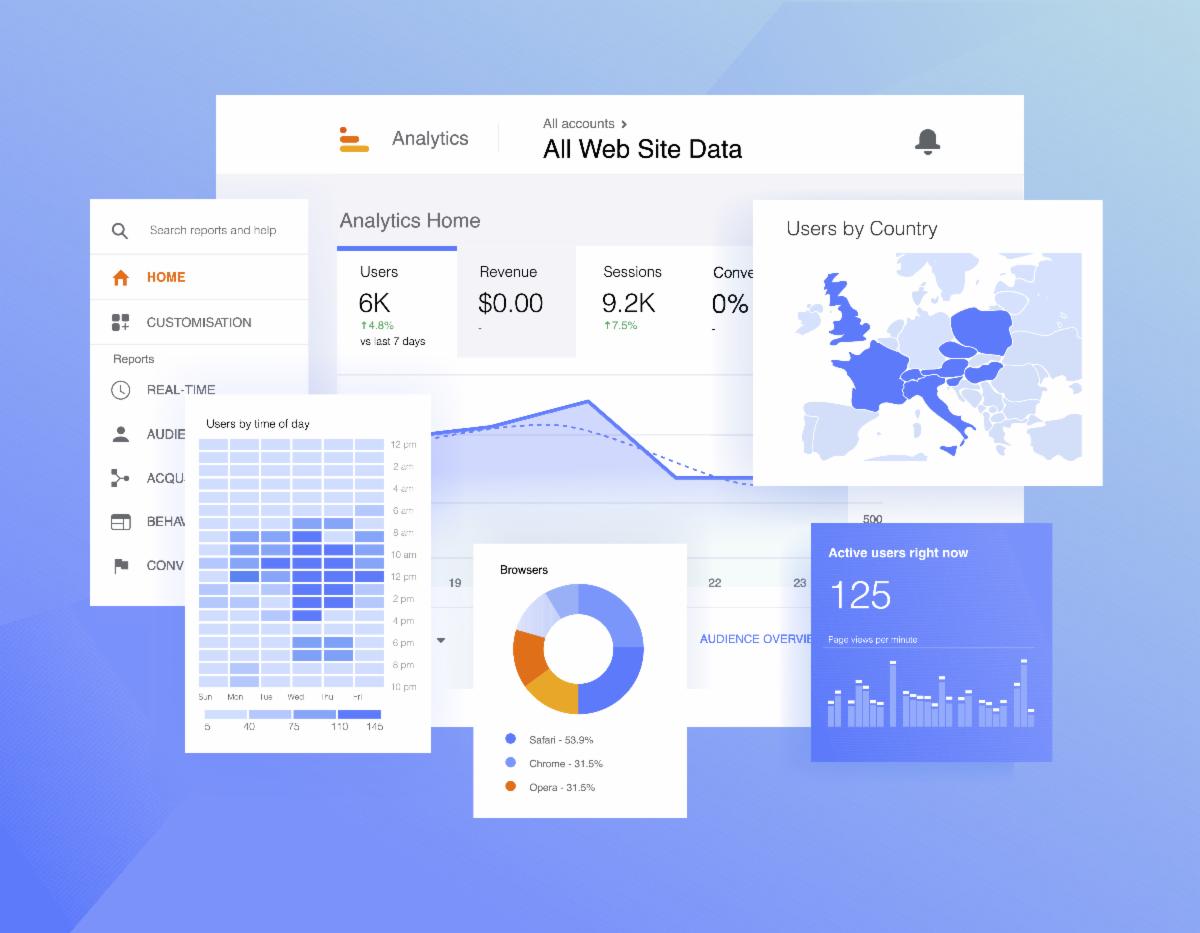

Keeping up with the steady stream of financial litigations is easy with CCC's Class Action Monitoring site. Here you'll find the entire securities, antitrust, and foreign class action world in one easy-to-use website. Log in to find:

You don't have to check dozens of claims administrators' and plaintiff attorneys' websites each week, or simply pray you don't miss a settlement notice. CCC gives you over a decade of information in one simple portal.

Download The Presentation

There have been over 1200 complaints filed in the last three years, over 600 settlements in the past five years, and scores of foreign litigations each year. And yet, there is no central hub for all this information. Add to that the fact that class actions are only getting more common, not less. Each year purchasers of thousands of securities are eligible to participate in all these litigations. That means several thousand symbols, CUSIPs, ISINs and other arcane identifiers to gather each year-- sometimes hundreds for a single case! Should we mention there are nearly two dozen claims administrators? That no two settlements are alike? That most of the time the administrators provide no security identifier information whatsoever, so you gotta search for that too?

You already have a full-time job. Using CCC's online portal for class action monitoring is the smart solution. Instead of tracking over twenty claims administrator websites each day, setting up email alerts, and praying that no notice is lost in the mail, you can access the vast world of class actions 24 hours a day on CCC's user-friendly website. And if you have any questions about any of the hundreds of cases on our site, our experts are just a phone call away.