Filing securities class action claims is tedious, complicated, and time-consuming. Managing a multitude of claims from notice to filing to distribution for hundreds of cases over the span of years, even decades, is inefficient and impractical. Yet, hedge funds have a duty to their partners, as well as a clear economic interest to extract every dollar owed their funds. What to do?

Download The Presentation

Chicago Clearing Corporation (CCC) can manage the entire process.

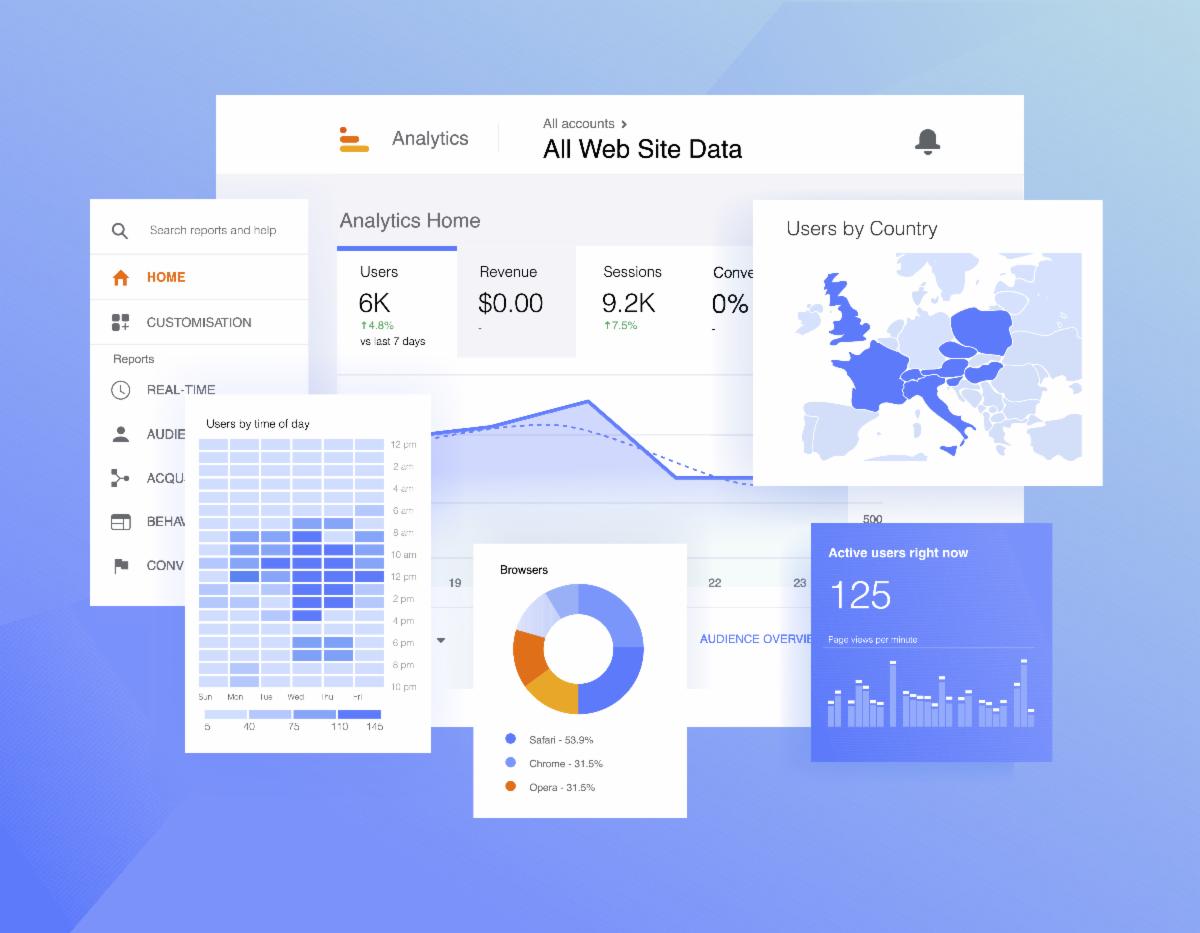

From monitoring to filing to tracking to payout, CCC can free up your time to better serve your valued clients. Utilizing CCC's vast array of class action services is the smart way for hedge funds to satisfy increasing regulatory and client demands, provide invaluable client services, and afford peace of mind.

Chicago Clearing is perfectly suited for financial class action recovery thanks to our dual expertise in both the legal and financial industries. First, there is the class action acumen: since 1993 CCC has been a leader in the class action settlement world, from creating coupon recovery markets after consumer class actions to consulting on equitable settlements in countless litigations. Second, there is the financial knowledge of CCC's CEO James Tharin and his team. Mr. Tharin is a former Chicago Board Options Exchange market maker, and the core of his staff are back-office trading firm specialists with a combined 150 years in finance.

Founded in 1993, CCC has help class members recover over $700 million in settlement funds since our inception. When savvy investors have questions about securities cases, from cases filed yesterday to the ones that settled ten years ago (or more), they turn to CCCs. When plaintiff attorneys need advice on creating an equitable settlement, they turn to CCC. Our advanced claims tracking methodology, data retrieval mastery, processing powers and proprietary technologies are unparalleled.

Let CCC manage the entire claim filing process:

CCC takes the burden of claim filing off your shoulders and turns it into a reliable, even predictable, stream of recovery. All that and great customer service too!

Find out why over 1300 institutional investors rely on CCC to steward their class action recoveries. Call us today, and one of our team members will be happy to field any question you have.